How to Beat Inflation

It’s the economy, stupid.

Bill Clinton used this catchphrase to get into the White House. His political strategists understood that the strength of the economy was most important to American voters.

The economy lies at the center of all public life. And it isn’t just about money. Many people think about “the economy” as merely the cost of rent, taxes or the price at the pump.

This is a narrow view and too much of this kind of thinking gets us into a lot of trouble.

What’s the Economy All About, Then?

Economy comes from the word economic which means:

Of, relating to, or based on the production, distribution, and consumption of goods and services

Origin: from the Greek word oikonómos “manager of a household, steward”

—Merriam-Webster dictionary

It’s interesting that the concept came from the running of a household; the basic economy of any functional civilization. Anyway…

So, what does this really mean? Here is an example of a smaller-scale economy to illustrate the important bits:

The five or six employees of a small restaurant all take actions that together result in meals being served in a nice environment. The customers pay a fair price for the service and hopefully leave a nice tip.

In order for the business to succeed, each employee needs to contribute more value than they take in terms of pay and the expense of employing them. If they contribute less than what they take out of it in terms of pay and lost opportunity, the business fails.

Now, one or two people not pulling their weight won’t necessarily sink the company. But, if the collective average value goes below the operating costs for too long there will be no more restaurant.

Scale this simple formula up to a nation. Every single person in the country participates in its economy—even if they don’t have a job. No contribution has a negative effect on the economy, because they are still consuming.

Fundamentally, this is not much different from the restaurant scenario. If the people in the country don’t add more value than they consume, it will fail. The only question is how long it will drag out.

What is Inflation?

Right now, the United States is in bad shape financially. Much more money is being spent with relation to how much Americans are producing.

On the outside, everything appears to be fine to the causal observer. Well, maybe not fine but at least not catastrophic. Why no apparent meltdown? This is because the government has a magic money printer to make up for the imbalances.

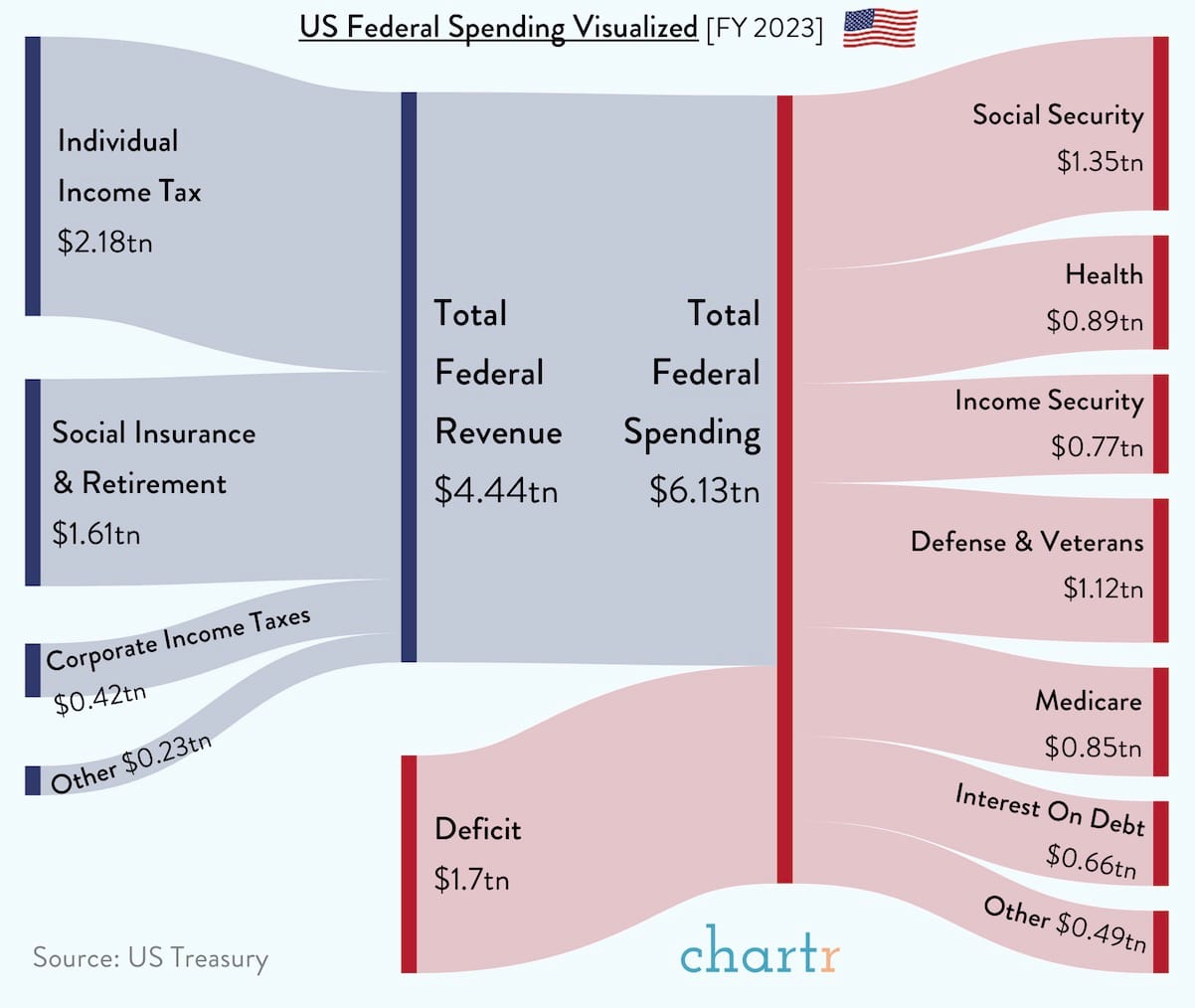

See that $2.77 trillion dollar deficit in the graphic above? That is the net loss of the US government’s budget every year.

The losses can be artificially compensated for with more dollars being pushed into the money supply, thus creating gargantuan debt while still paying the bills.

The problem with this is that inflation becomes really noticeable down at the individual level. So another “tool” the government uses is to increase the basic interest rate (called the prime rate) for all loans. Depending on the type of loan the bank usually adds more to this rate.

This is done solely to reduce the demand for goods and services, which they think will help reduce inflation as people seek less goods and services.

It only appears to work. The effect is temporary, as the number of dollars available increase while the amount of goods and services being produced don’t keep up. The result is always less. Less production causes less value, less value means your dollars buy less.

And this brings me to my next point: in any economy money is not the boss. Service is.

Service is The Key

What's most important is that a high level of service is being delivered at any given time.

Service means doing something valuable to benefit someone else. The phrase “goods and services” is often used when discussing economics, but it can be a bit misleading…

A “good” is a product bought and sold. But how did it come into existence? A person had to invent it, design it, get the materials together to make it, make it, package it and so on. All of these are services which result in the good being produced.

In terms of real economics there is no difference between writing a book and selling a laptop. Essentially both are the product of services.

How to Beat Inflation

Now lets take a look at the US economy with all this in mind. Ignore the technical details and just think about the essential component: service.

If value isn’t created through people exerting effort to produce a product that can be exchanged, there will be no new wealth. If more people were producing then there will be more wealth and the economy will expand.

It’s actually not true that inflation dilutes an economy; the value of goods and services remain relatively constant.

Here’s what I mean: if you work for a day to fix a car you will have produced something of value to someone else, the car owner. Let's say it was worth $100.

Now we take the same scenario but add inflation. There was just another big round of payments to unemployment benefits and suddenly these people that aren’t working are adding more dollars to the economy but no new value.

Inflation lessens the power of the dollar. It does not lessen the value of the service.

The car repair now costs $150. The man doing the repair is unaffected by inflation because he is getting the value equivalent of his work, not the dollar equivalent.

Of course this is overly simplistic and there are many other factors involved in the real world. But it does serve as an example that we need to focus less on the amount of dollars in society and focus more on adding value into the society.

Investing and Speculation

I don’t want to stray too far from the topic but I felt this note needed to be included.

An investment is value you put into activity to help it grow so that it will return more value to you in the future.

This has been a very important function of society and has helped to create the businesses and great products we have today.

However, as with all good things, this can be abused. Here we see speculation.

Speculation looks like investing but the difference is that with speculation you are trying to get a big gain in the short term through a risky transaction and don’t intend to help the activity expand.

You’re trying to make a gain and then pull your “winnings”. Sometimes you lose. And even if you win, the economy loses to that degree.

How many of your investments are purely speculation? Are you invested in a company or product that you think is really going to take off?

Conclusion

This system called “capitalism” has brought untold wealth to mankind. No other system has brought more riches to the common man than the free market.

It drives innovation, growth and prosperity in all sectors of the economy.

I hope this perspective has added value to your life. I believe that it’s the duty of all citizens of a society to contribute value into their economy. The more this is done, the more true wealth there is to spread around. You will eventually find yourself in a better condition.

Comments ()